In the fast-paced world of entrepreneurship, managing finances efficiently is crucial for success. Yet, for many entrepreneurs, navigating the complexities of financial management can be daunting. This is where finance management software steps in, offering a lifeline by simplifying and streamlining financial tasks. In this article, we’ll delve into the importance of finance management for entrepreneurs and explore how finance management software can make this process significantly easier.

Importance of Finance Management for Entrepreneurs

Entrepreneurs wear many hats, from innovator to marketer to manager. However, one of the most critical roles they play is that of a financial steward. Proper finance management is the backbone of any successful business, regardless of its size or industry. It involves budgeting, tracking expenses, invoicing clients, managing cash flow, and much more. Without effective finance management, businesses can quickly find themselves in turbulent waters, facing cash flow crises, overspending, or missed opportunities for growth.

Introduction to Finance Management Software

Finance management software offers entrepreneurs a comprehensive solution to tackle their financial tasks with ease and efficiency. These software solutions are designed to automate repetitive tasks, provide real-time insights into financial data, and streamline processes, ultimately empowering entrepreneurs to make informed decisions and drive their businesses forward.

Benefits of Finance Management Software

- Automation: Manual financial tasks can be time-consuming and prone to errors. Finance management software automates these tasks, such as invoicing, expense tracking, and reconciliations, saving entrepreneurs valuable time and reducing the risk of mistakes.

- Real-time Insights: With finance management software, entrepreneurs have access to up-to-date financial data at their fingertips. This real-time visibility allows for better decision-making, as entrepreneurs can quickly assess their financial health and identify areas for improvement.

- Improved Accuracy: The automation and standardized processes offered by finance management software enhance accuracy in financial reporting and analysis. This reduces the likelihood of errors and ensures compliance with regulatory requirements.

- Streamlined Processes: From creating and sending invoices to managing expenses and tracking payments, finance management software streamlines essential financial processes, making them more efficient and less prone to bottlenecks.

- Better Financial Planning: With features such as budgeting and forecasting tools, finance management software enables entrepreneurs to plan and strategize effectively for the future. By setting financial goals and tracking progress against them, entrepreneurs can steer their businesses towards long-term success.

Challenges of Finance Management for Entrepreneurs

Entrepreneurs face a multitude of challenges when it comes to managing their finances. Let’s delve into some of the most common hurdles they encounter:

Lack of Expertise in Finance

Many entrepreneurs dive into their ventures with passion and drive but may lack formal training or experience in finance. This can pose a significant challenge when it comes to understanding complex financial concepts or making informed decisions about budgeting, cash flow management, or financial planning.

Time Constraints

Running a business demands a considerable amount of time and energy, leaving entrepreneurs with limited bandwidth to dedicate to financial tasks. From overseeing operations to handling customer inquiries and managing employees, entrepreneurs often find themselves stretched thin, making it difficult to devote sufficient time to finance management.

Risk of Errors in Manual Processes

Manual financial processes, such as spreadsheet-based accounting or paper-based invoicing, are prone to human error. Even small mistakes can have significant consequences, leading to inaccurate financial reporting, discrepancies in records, or missed opportunities to optimize financial performance.

Transitioning from manual to automated finance management can alleviate these challenges, providing entrepreneurs with the tools and resources they need to navigate their finances with confidence and efficiency. Let’s explore how finance management software can help entrepreneurs overcome these obstacles and streamline their financial operations.

Benefits of Finance Management Software

Finance management software offers a plethora of advantages for entrepreneurs, making the daunting task of managing finances much more manageable. Let’s explore some of the key benefits:

Automation of Financial Tasks

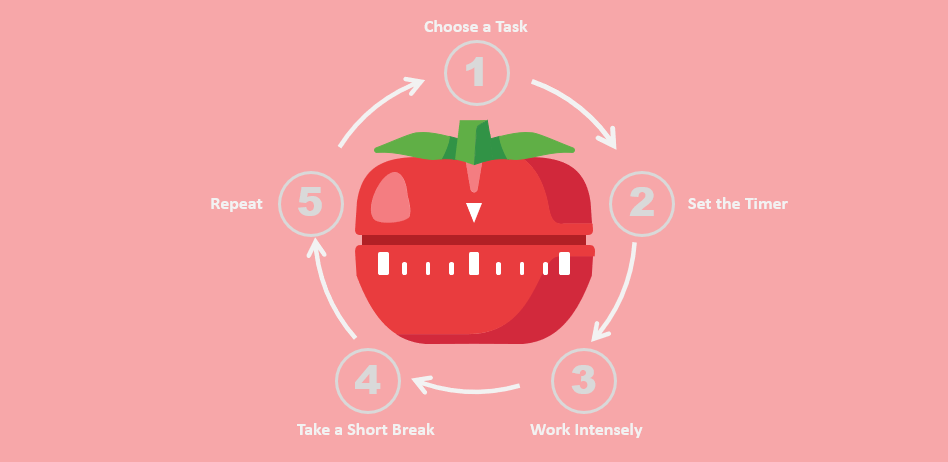

One of the most significant advantages of finance management software is its ability to automate repetitive financial tasks. This means that entrepreneurs can say goodbye to manual data entry and tedious calculations, freeing up valuable time to focus on other aspects of their business.

Real-time Visibility into Financial Data

With finance management software, entrepreneurs can access real-time insights into their financial performance. This means no more waiting for month-end reports or sifting through spreadsheets to get a clear picture of where their business stands financially. Instead, they can make informed decisions based on up-to-date information.

Improved Accuracy and Reduced Risk of Errors

Manual financial processes are prone to human error, which can lead to costly mistakes. Finance management software minimizes these risks by automating calculations and standardizing processes, ensuring accuracy in financial reporting and analysis.

Streamlined Invoicing and Expense Tracking

Finance management software simplifies invoicing and expense tracking, allowing entrepreneurs to create and send invoices with ease and track expenses effortlessly. This not only saves time but also helps to ensure that invoices are paid on time and expenses are properly recorded.

Better Decision-making with Data-driven Insights

Perhaps the most valuable benefit of finance management software is its ability to provide entrepreneurs with data-driven insights. By analyzing financial data, entrepreneurs can identify trends, spot opportunities for growth, and make informed decisions about the future of their business.

Finance management software empowers entrepreneurs to take control of their finances, streamline processes, and make smarter decisions. It’s a valuable tool for any business looking to achieve financial success and thrive in today’s competitive landscape.

Key Features to Look for in Finance Management Software

When selecting finance management software for your entrepreneurial venture, it’s essential to consider the key features that will best suit your business needs. Let’s explore some of the essential features to look for:

Budgeting and Forecasting Tools

Budgeting and forecasting tools are vital for entrepreneurs to plan and manage their finances effectively. These features allow you to set financial goals, create budgets, and forecast future cash flow, helping you make informed decisions about resource allocation and business strategy.

Expense Tracking and Management

Keeping track of expenses is crucial for maintaining financial health and ensuring that your business stays within budget. Look for finance management software that offers robust expense tracking and management capabilities, allowing you to categorize expenses, track spending in real-time, and generate expense reports effortlessly.

Invoicing and Billing Capabilities

Invoicing and billing capabilities are essential for entrepreneurs who need to send invoices to clients and customers promptly. Choose finance management software that streamlines the invoicing process, allowing you to create professional-looking invoices, set up recurring billing, and track payments easily.

Integration with Bank Accounts and Other Financial Tools

Integration with bank accounts and other financial tools is essential for seamless financial management. Look for finance management software that integrates with your bank accounts, credit cards, and other financial institutions, allowing you to sync transactions automatically and reconcile accounts effortlessly.

Reporting and Analytics Functionalities

Reporting and analytics functionalities provide valuable insights into your business’s financial performance. Choose finance management software that offers robust reporting tools, allowing you to generate customized financial reports, analyze key metrics, and gain actionable insights to drive business growth.

Tips for Choosing the Right Finance Management Software

Choosing the right finance management software for your entrepreneurial venture can be a daunting task. However, by following these tips, you can make the process much easier and ensure that you select a solution that meets your business needs:

Assessing your Business Needs and Budget

Before diving into the sea of finance management software options, take some time to assess your business’s specific needs and budget. Consider factors such as the size and complexity of your business, the number of users who will need access to the software, and the features you require to manage your finances effectively. Determine how much you are willing to invest in finance management software and set a budget accordingly.

Researching and Comparing Different Software Options

Once you have a clear understanding of your business needs and budget, start researching and comparing different finance management software options. Look for software that offers the features you need at a price point that fits your budget. Take advantage of free trials or demos to test out the software and see if it meets your requirements. Read reviews from other users and industry experts to get an idea of the software’s strengths and weaknesses.

Considering Scalability and Future Growth

When choosing finance management software, it’s essential to consider scalability and future growth. You want a solution that can grow with your business and accommodate your changing needs over time. Look for software that offers flexible pricing plans and scalable features, allowing you to add or remove users and upgrade to more advanced functionality as your business grows. Consider how the software integrates with other tools and systems you use and whether it can adapt to future technology trends and advancements.

Implementation and Training

Implementing finance management software in your entrepreneurial venture is a crucial step towards streamlining your financial processes and improving efficiency. However, it’s essential to approach the implementation process thoughtfully and ensure that your employees are adequately trained to use the software effectively.

Steps for Implementing Finance Management Software

- Assess Your Needs: Before implementing finance management software, assess your business’s specific needs and goals. Determine which features are essential for your business and how you will integrate the software into your existing workflows.

- Choose the Right Software: Selecting the right finance management software is key to successful implementation. Consider factors such as ease of use, scalability, integration capabilities, and cost when choosing a software solution.

- Plan the Implementation Process: Develop a comprehensive implementation plan outlining the steps involved in deploying the software. Assign roles and responsibilities to team members involved in the implementation process and set realistic timelines for each stage.

- Data Migration: If you are transitioning from manual processes or switching from another software solution, ensure that your data is migrated accurately to the new system. This may involve importing data from spreadsheets or other accounting software.

- Training and Onboarding: Provide thorough training and onboarding for employees who will be using the finance management software. Offer hands-on training sessions, tutorials, and resources to help them become familiar with the software’s features and functionalities.

- Customization and Configuration: Customize the software to meet your business’s specific needs and configure settings to align with your workflows. This may involve setting up chart of accounts, creating custom reports, or configuring invoicing templates.

- Testing and Quality Assurance: Before fully deploying the software, conduct thorough testing to ensure that it functions as expected and meets your business requirements. Identify and address any issues or bugs that arise during testing to ensure a smooth transition.

- Go-live and Support: Once testing is complete, launch the finance management software and provide ongoing support to employees as they begin using the system. Address any questions or concerns promptly and offer additional training or resources as needed.

Importance of Training Employees on How to Use the Software Effectively

Training employees on how to use finance management software effectively is essential for maximizing the benefits of the system and ensuring its successful implementation. Here’s why training is crucial:

- Increased Efficiency: Proper training enables employees to use the software efficiently, reducing the time and effort required to complete financial tasks.

- Accuracy and Compliance: Well-trained employees are less likely to make errors when using the software, ensuring accurate financial reporting and compliance with regulatory requirements.

- Empowered Decision-making: Training empowers employees to leverage the full capabilities of the software, enabling them to access valuable insights and make informed decisions based on real-time data.

- User Adoption: Effective training increases user adoption of the software, ensuring that employees embrace the new system and use it consistently in their day-to-day workflows.

Conclusion

In conclusion, finance management software is a powerful tool for entrepreneurs looking to streamline their financial processes and take control of their finances with ease. By automating repetitive tasks, providing real-time visibility into financial data, and offering robust reporting and analytics functionalities, finance management software empowers entrepreneurs to make informed decisions and drive their businesses forward.

When choosing finance management software, it’s essential to assess your business needs and budget, research different options, and consider scalability and future growth. Additionally, effective implementation and thorough training for employees are critical for maximizing the benefits of the software and ensuring its successful adoption.

With the right finance management software in place, entrepreneurs can overcome the challenges of financial management, improve efficiency, and achieve greater financial success in their ventures.